Alberta Teachers’ Retirement Fund Information

On October 7, 2020, the Alberta Teachers’ Retirement Fund (ATRF) presented to the delegates of the ARTA AGM on the previous year and current status of the teachers’ pension fund. The presentation can be seen below.

- Established in 1939

- Provincial Corporation created by legislation

- Treasury Board and Finance has responsibility for legislation

- Minister of Education has authority for plan rules

- ATRF Board is trustee, administrator and custodian of the assets of the Teachers’ Pension Plan, post-1992 fund (TPP) and the Private School Teachers’ Pension Plan (PSTPP)

Our Mission: Working in partnership to secure your pension income

ATRF Board

- Sandra Johnston

- Karen Elgert

- Greg Francis

- Paul Haggis

- Maria Holowinsky

- Brad Langdale

- Rafi G. Tahmazian

- Tim Wiles

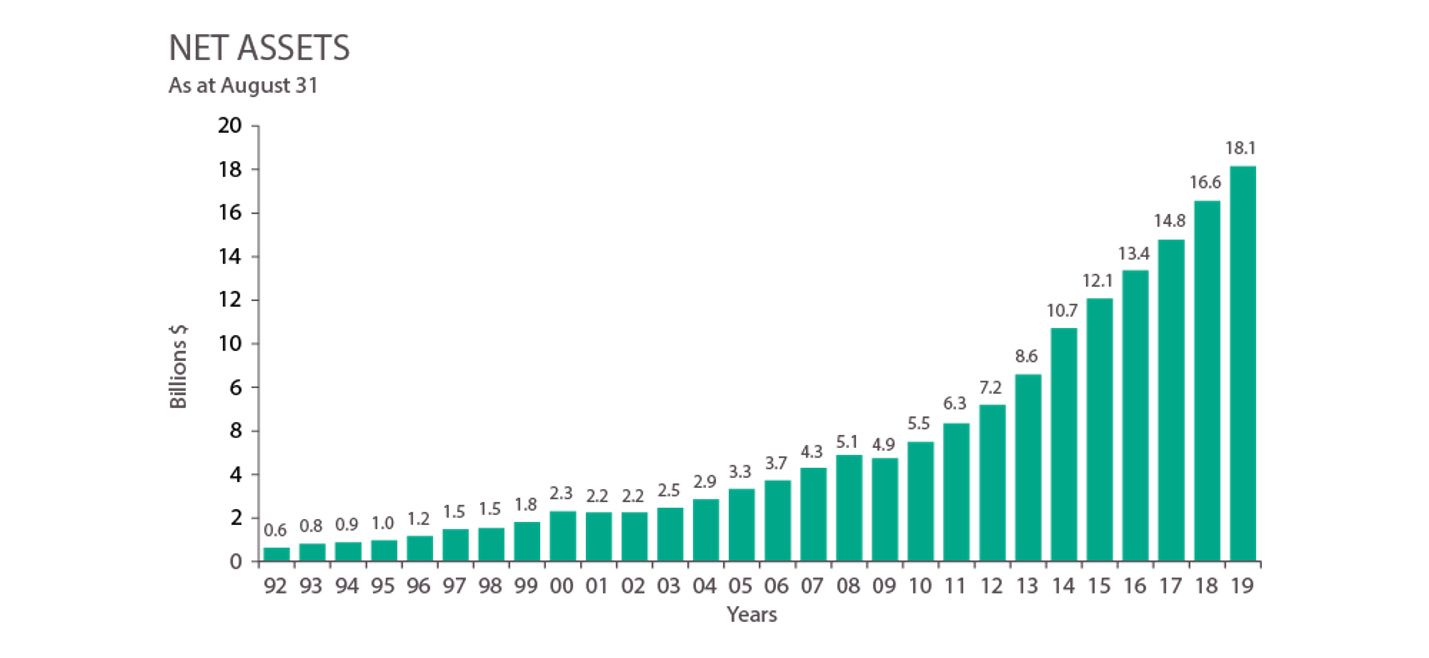

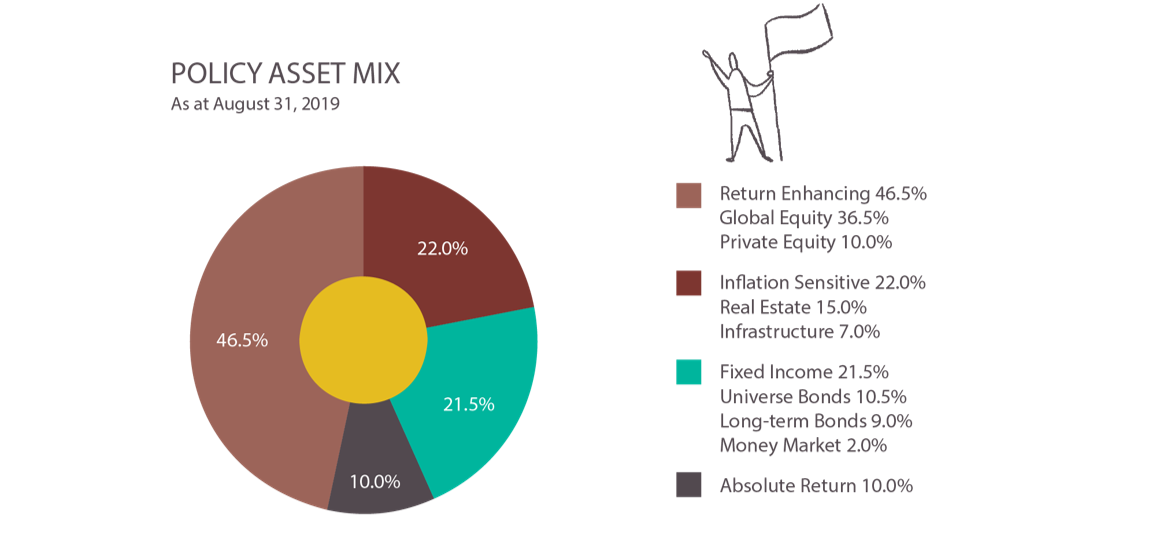

2018-19 Highlights

| Rate of Return | ATRF | Benchmark |

| 2018-19 return | 7.8% | 6.4% |

| Four-year return | 7.9% | 7.1% |

| Ten-year return | 9.2% | 8.3% |

2020 market Volatility

- ATRF was not immune to the capital market volatility in March caused by the Coronavirus pandemic crisis

- Our investment strategy driven by capital preservation and appropriate risk management held us in good stead

- We expect a positive fund return for 2019-20 around 5%, in line with the funding discount rate

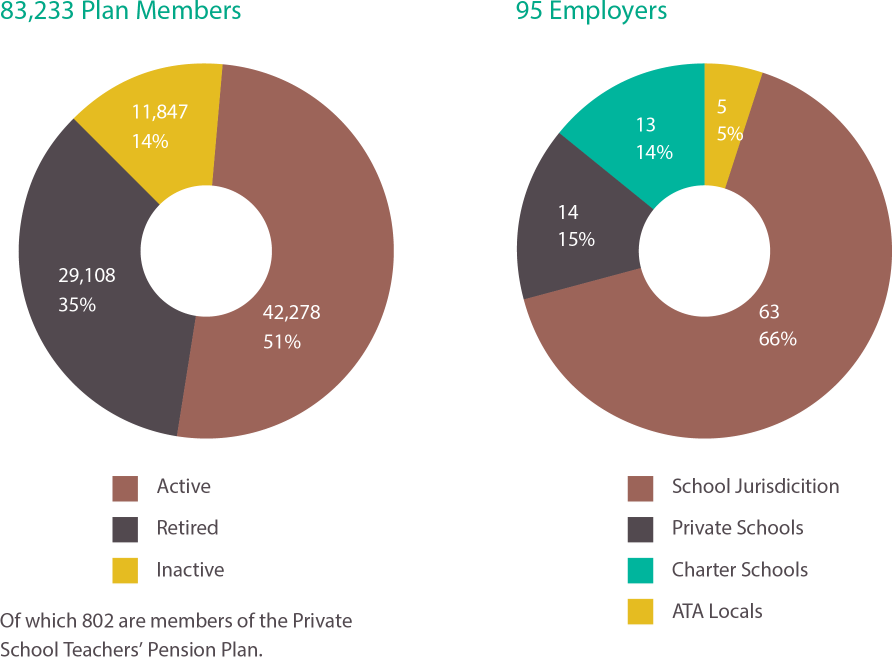

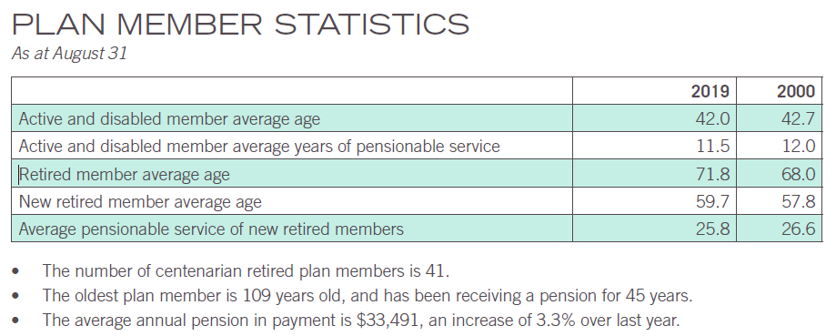

2018-19 Highlights – Who We Serve

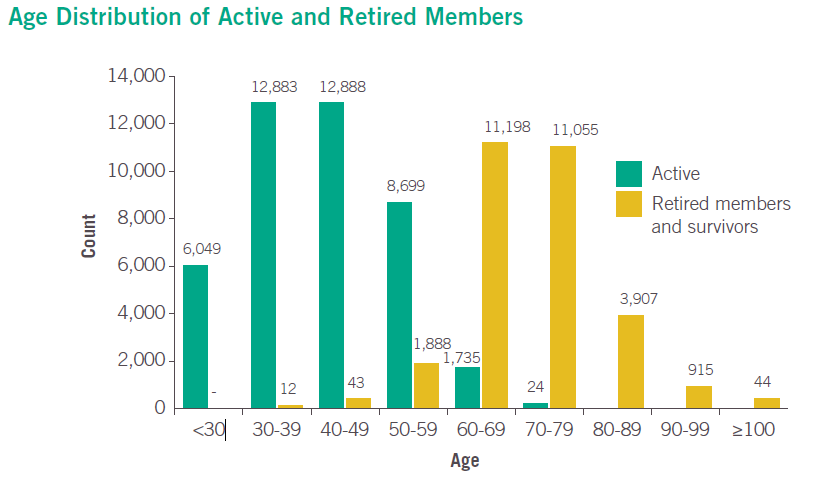

ATRF membership grew 2% over the past year and is estimated to reach almost 100,000 members by 2030.

| Active | Retired | |

| Male | 26% | 36% |

| Female | 74% | 64% |

| Average age | 42.0 | 71.8 |

| Average pensionable service | 11.5 | |

| Average annual salary/pension | $91,900 | $33,491 |

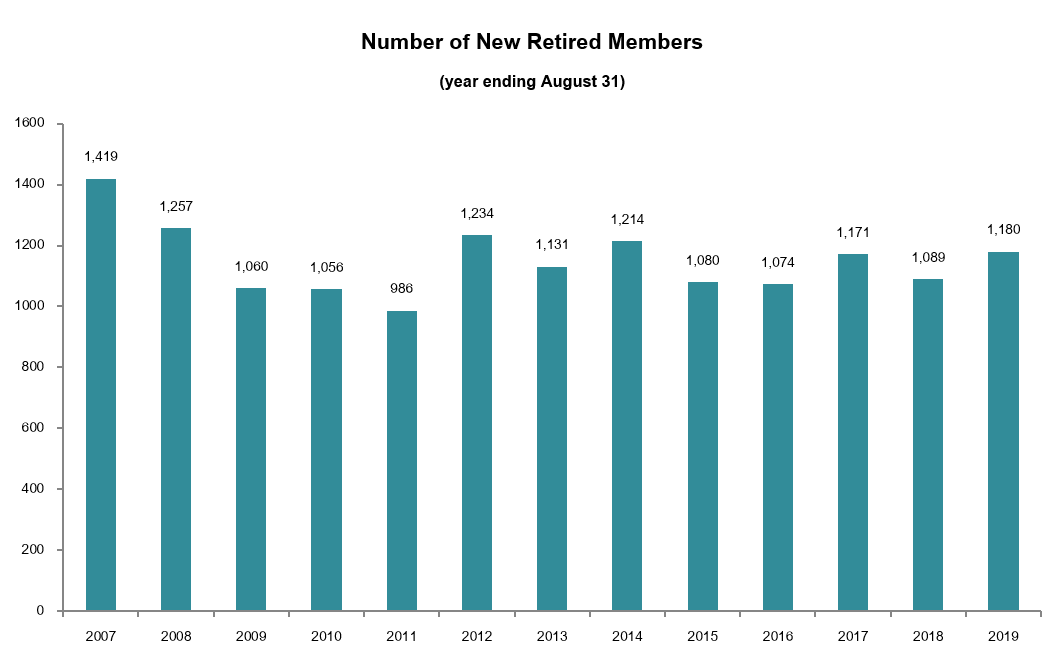

| New retired member average age | 59.7 |

| Average pensionable service of new retired member | 25.8 |

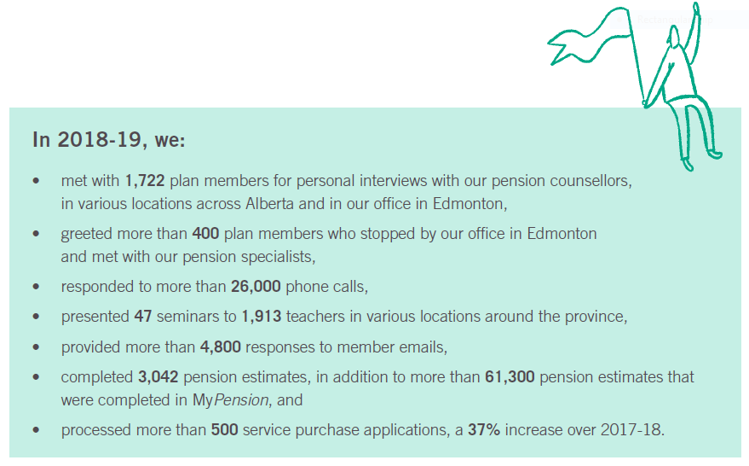

ATRF pension administration cost: $120 per member per year in 2018-19, compared to an average cost of $156 per member for a peer group of Canadian pension plans

Services and Communications to Retired Plan Members

- New direct deposit (instead of cheques by mail) of monthly pensions for retired members living outside of North America

- New and improved annual pension information statements sent to all retired plan members last January

- We would love to hear your feedback and suggestions on our communications

- Stay tuned for

- Our 2020 Annual Report

- Your January 1, 2021 Cost-of-Living-Adjustments

- Pension Update Electronic Newsletters

- It’s important to provide us your updated email address to receive

timely and useful information from ATRF

- It’s important to provide us your updated email address to receive

The Voice of Our Clients

Results of 2019 Plan Member Survey

14,000 member responses, of which more than 7,000 were retired members

26% response rate from 53,000 surveys sent

- Customer service rating: 94% good to excellent

- MyPension online portal: 95% good to excellent

- ATRF website: 94% good to excellent

- ATRF communications materials: 90% good to excellent

- ATRF services to members: 87% good to excellent

New retired members in 2018-19 gave a 95% satisfaction score for the overall level of service they received from ATRF during their retirement process

TPP – Financial Position (in $millions)

| Post-1992 only ($000,000’s) | Aug 2015 | Aug 2016 | Aug 2017 | Aug 2018 | Aug 2019 |

| Assets | |||||

| Market Value | $12,011 | $13,291 | $14,695 | $16,470 | $18,045 |

| Fluctuation Reserve | (1,201) | (1,109) | (905) | (690) | (813) |

| Actuarial Asset Value | $10,810 | $12,182 | $13,790 | $15,780 | $17,232 |

| Liabilities | |||||

| Active/Disabled | $7,437 | $7,921 | $8,255 | $9,271 | $9,077 |

| Inactive | 525 | 547 | 595 | 631 | 651 |

| Pensioner/Beneficiary | 5,212 | 5,664 | 6,456 | 7,064 | 8,367 |

| Total Liabilities | $13,174 | $14,132 | $15,306 | $16,966 | $18,095 |

| Surplus/(Unfunded Liability) | ($2,364) | ($1,950) | ($1,516) | ($1,186) | ($863) |

| Funded Ratio | 82% | 86% | 90% | 93% | 95% |

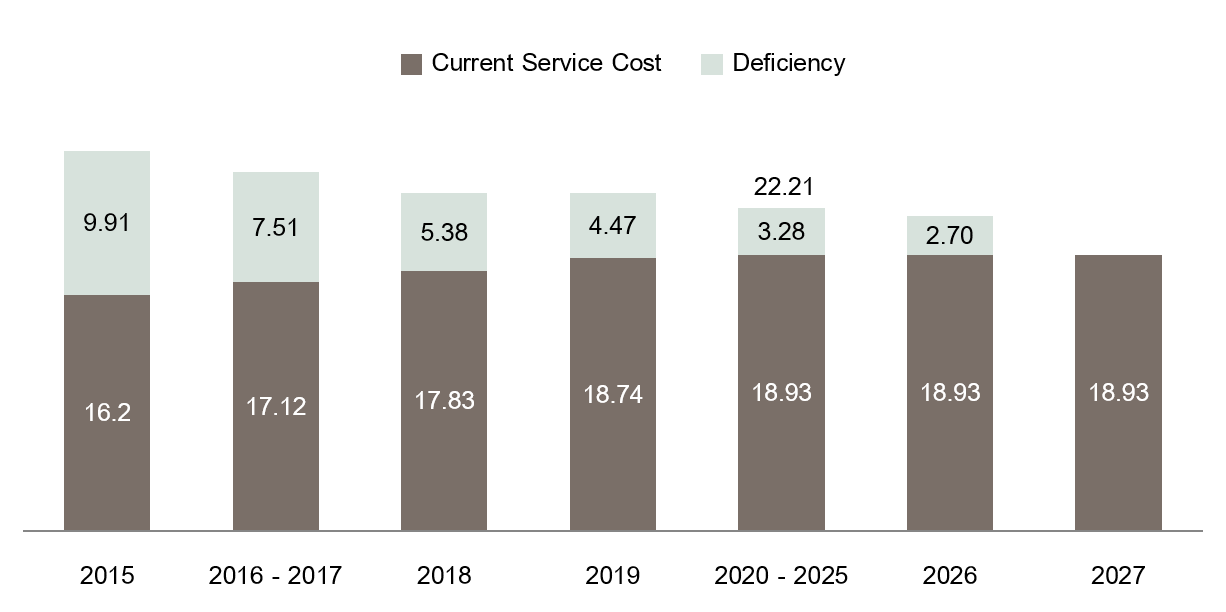

Funding Sustainability

- Plans’ funded ratio improved again, remaining on a path to full funding

- The asset-smoothing adjustment (fluctuation reserve) of $813 million in the TPP will serve to offset potentially lower than expected future market returns

- The TPP is a relatively young plan, projected to have positive cash flow over the next several years, no liquidity risk, and stable membership; however the plan maturity is increasing at a faster pace

TPP – Contribution Rates

- ATRF Board approved a contribution rate reduction effective September 1, 2020, the third reduction since 2016

Rates as of September 1 (% of teachers’ salaries)

We encourage you to contact ATRF staff for any pension questions – we are your pension experts

By email: retiredmember@atrf.com

By phone: 1-800-661-9582